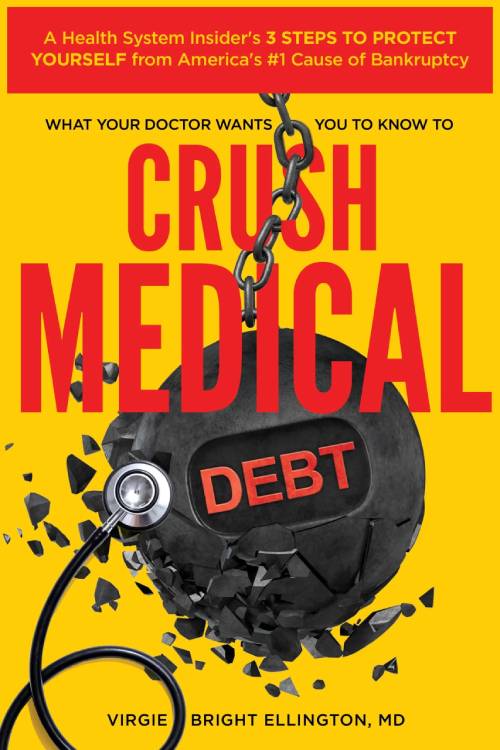

Crush Your Medical Debt

One Medical Bill at a Time!

Don’t let high medical bills make you an American healthcare cost victim! Because 80% to 90% of all medical bills have mistakes, most adults living in the United States are just one accident or serious illness away from a lifetime of debt – and that’s NOT okay.

But together we can change that.

FAQS

Whenever you get a medical bill – no matter how large or small – protect yourself from getting overcharged and ruining your financial future by remembering the 3 steps of the only right way to pay a medical bill.

1. Call the provider’s billing department to ask for “a bill with CPT codes”.

CPT codes are to medical services what barcodes are to products in a store: Every U.S. medical service (test, procedure, ER visit, office visit, etc.) has a CPT code.

Don’t be discouraged if the billing department pushes back on you–they’re trained to do this. You need to be persistent and get the right information from them. It could save you thousands!

2. Google each CPT code to get a description of the billed medical service and what Medicare pays for the service.

This ensures that the services for which you’re being charged sound like what you received, meaning, you haven’t been billed for the same service twice or billed for a service you didn’t receive, for example.

Also, Medicare rates are the fairest prices to pay for medical services provided in the United States.

This is the price you’re willing to pay for the services you received.

3. Call back the provider’s billing department to request an interest-free payment plan that you can afford for the services you received.

For example, let’s say you determine Medicare pays only $3000 for the same services after applying the first two steps to a bill for which you’re being charged $10,000.

Also, let’s say you can only afford $50 a month to pay toward the bill.

Call back the provider’s billing department to tell them you’re able and willing to pay $3000 for the bill at payments of $50 a month for 60 months.

Don’t be afraid of paying them back in small amounts. Because so many medical bills go to collections, medical clinics and hospitals are eager to make a deal with you to get them to pay back anything–even if it’s at a low monthly rate.

The number one mistake adults living in the United States can make that can destroy their financial future is to go without health insurance.

Insurance protects us from possible life events that we can’t afford to pay for.

For example, banks and mortgage companies require us to have home insurance in case of major damage from fire or flooding.

States require car owners to maintain insurance in case of accidents in which the car sustains major damage and if someone needs significant medical care from injuries.

Because medical bills are America’s #1 cause of debt and bankruptcy, health insurance helps reduce some financial risk of accident or serious illness.

Why do people who are unemployed need to stay insured?

Medical insurance is even more critical when we have significantly reduced or no income.

Life happens.We get sick. Accidents happen.

Risk of bankruptcy or a lifetime of debt due to needed medical care is more likely if we’re unemployed.

How does health insurance work for the employed vs. unemployed?

Most adults living in the U.S. have health insurance through an employer.

Because employers who provide medical insurance for employees pay for a large portion of monthly premiums, health insurance becomes accessible for those who otherwise are not able to afford costly health insurance premiums.

For those living in the U.S. who don’t have insurance through an employer, coverage is purchased through private brokers or the Federal Marketplace, also known as the Affordable Care Act (ACA) or Obamacare.

Unfortunately, even though federal subsidies for purchasing coverage through the Federal Marketplace are made available for those with limited income but still make too much to be eligible for state Medicaid insurance, monthly premiums are unaffordable for many.

What insurance options are available if you’re unemployed?

For the first 18 months after separating from an employer, you’re eligible for continuing your insurance plan through COBRA.

However, you’re now required to pay for the entire monthly premium, including the amount the employer had been paying.

This can be prohibitive for many – especially in the setting of no income.

After COBRA coverage expires or you decide the monthly premiums are unaffordable, the Federal Marketplace/Exchange is your next option.

If you’re age 29 or younger, you can obtain catastrophic health insurance through the Federal Marketplace.

Catastrophic medical insurance doesn’t cover you for routine care or simple injuries or illnesses, but it can save you from financial ruin in case of an accident or event requiring hospitalization.

If you’re 29 or older, look at three sets of numbers:

- The monthly premium

- The annual deductible (the amount you must spend before the insurance starts to kick in), and

- The amount of coinsurance (percentage of costs you share with the insurance once you’ve met your annual deductible).

The Federal Marketplace levels of insurance plans are described as Platinum, Gold, Silver, and Bronze.

However, the different levels of these plans do not describe differences in best, good, or fair quality of medical coverage.

All federal marketplace insurance plans offer the same quality of healthcare coverage.

The differences are determined by out-of-pocket costs – meaning, how much the monthly premiums are and what percentage of coinsurance for which you’re responsible.

For example, Platinum plans have the highest up-front monthly premiums but the lowest coinsurance percentage for which you’re on the hook once you’ve met your annual deductible.

In Platinum plans, the insurer pays 90% of the costs for medical services; you pay 10%.

Bronze plans have the lowest premiums but the highest out-of-pocket costs when you need care – the insurance company only pays 60%; you’re responsible for the remaining 40%.

Another option is non-ACA individual plans, also known as off-exchange plans, which are health insurance options that are not regulated by the ACA.

These plans often offer more flexibility in terms of coverage and pricing.

While they may not provide the same level of comprehensive coverage as ACA plans, they can be a viable option if you are looking for more affordable premiums or if you don’t require certain benefits mandated by Obamacare.

What should you keep in mind when choosing an insurance plan without a job?

Understandably, many focus on the lowest monthly premiums when looking for insurance coverage without a job.

If you don’t have a chronic illness or injury, this is usually the best long-term option.

However, those who need regular medical care should look at plans with higher monthly premiums because out-of-pocket costs – the percentage of coinsurance you’re on the hook for – are less.

How can you save money on healthcare without having insurance?

Consider purchasing Direct Primary Care coverage in addition to critical illness health insurance sold by private insurance brokers.

Direct Primary Care (DPC) is a healthcare marketplace alternative to traditional health insurance that focuses on providing primary care services directly to patients for a fixed membership fee.

By bypassing insurance companies, DPC practices can offer affordable and personalized care. With a DPC membership, you have unlimited primary care visits, discounted lab tests, and often access to telemedicine services.

Critical illness, hospitalization, and accidental insurance policies can provide financial support to cover medical expenses, lost income, or other costs associated with a serious illness or injury.

Combined with critical illness insurance policies, DPC can be a great alternative if you prioritize good health maintenance and preventive care.

Critical illness insurance pays a lump sum benefit upon the diagnosis of a covered critical illness, such as cancer, heart disease, or stroke.

If your health insurance coverage needs are for less than two or three years, short-term health insurance plans offer temporary coverage for individuals who need insurance for a limited duration, such as during a job transition or while waiting for ACA coverage to begin.

Short-term insurance plans usually have lower premiums but don’t offer the same level of comprehensive coverage as ACA plans.

Google the facility from which you received care to determine if it is non-profit or tax-exempt.

Non-profit facilities are required to give you an application to apply for an income-based discount for the services you received.

Depending on the institution, income-based discounts are called charity care, financial aid, or financial assistance.

Many for-profit facilities also offer income-based discounts.

Once you receive an adjusted bill after the income-based discounts are subtracted, remember to apply the 3 steps of the only right way to pay a medical bill.

1. Call the provider’s billing department to ask for “a bill with CPT codes”. As described above, CPT codes are the billing codes that cover every single aspect of every procedure.

2. Google each CPT code to get a description of the billed medical service and what Medicare pays for the service.

3. Call back the provider’s billing department to request an interest-free payment plan that you can afford for the services you received.

There are 3 big problems with using medical credit cards to pay our medical bills.

One, when we put medical bills on a medical credit card, we’re skipping the first two of the 3 steps of the only one right way to pay a medical bill.

We’re not getting a real, accurate bill with the CPT codes – a.k.a. bar codes like with products in a store – and therefore, we’re likely being overcharged for services we received and/or possibly charged for services we did not receive.

What this means is we’re paying up to 300% to 500% to even 2000% more than what we should be when we put bills on medical credit cards.

Second, even though medical credit cards have an interest-free period of time, it’s often only for a couple of years.

So, when interest rates rise – like now during the current economic environment – and we need longer to pay off the bill to be able to stay within our budget, the bill rises exponentially and can become even more unaffordable very quickly.

Third, the final step of the only right way to pay a medical bill is to get an interest-free payment plan with the medical facility that fits your budget – which does not get included on your credit report.

Medical credit cards can be included on your credit report, particularly if you miss payments on the card.

Whenever you get any medical bill for any care you receive – ambulance, hospital, or physical therapy, for example – always remember to apply the 3 steps of the only right way to pay a medical bill.

- Call the provider’s billing department to ask for “a bill with CPT codes”.

- Google each CPT code to get a description of the billed medical service and what Medicare pays for the service.This ensures that the services for which you’re being charged are what you actually received. For example, a common ambulance service mistake is billing a CPT code for non-emergent transportation when emergent transportation was provided. Because insurance never pays for non-emergent ambulance transportation, you’ll be stuck for the entire bill.

- After totalling what Medicare pays for the services you receive, this is the amount you’re willing to pay. Call back the provider’s billing department to request an interest-free monthly payment plan that you can afford.

Testimonials

“Get a copy of this book! You’re definitely going to need it in your lifetime – Dr. Virgie is on your side.”

– Jack Canfield

Co-author of the bestselling Chicken Soup for the Soul series

Pioneer in the field of Personal Development and Peak Performance

“This book is a must read if you are struggling with medical bills. We have all been in that situation where you think how am I going to pay for this? The book gives the knowledge to equip you with the relevant information and how to go about it with your finances. It will be a life saver for so many to avoid debt ridden situations in this credit crunching climate. Would so recommend to anyone who knows they have health issues or surgeries coming up.”

“Just as you might look at your grocery receipt to see if you were charged correctly, Dr. Virgie will show you how to read the medical bill, check it and take action. She provides an insider look at medical bills, how to look for errors and correct them. Don’t let medical debt crush you! Take charge.”

– Nancy Jo Braden, MD

“Crushing Medical Debt is the go-to book I wish I had BEFORE my mom’s shoulder surgery. She got hit with a $65,000 medical bill for emergency surgery after falling and breaking her shoulder. We had no idea how we were going to pay for it. Lucky for us, this book was written by a doctor and gives you the tools you need to handle medical debt without falling into the bankruptcy abyss. We were able to translate bewildering medical insurance jargon into clear-cut language and ended up only paying $20,000 instead of $65,000. #worthit”

“Critical reading for every American! Dr. Virgie knows the system and has composed an easy-to-follow book that will give you the necessary tools to defend and protect your loved ones from financial ruin. “

– Chris Schafer

Former Green Beret/United States Army Special Forces CEO, Tactical 16 Publishing

“This book surprised me. There is such good advice given here on how to help you get through a medical debt situation. However, the best advice of all is to read it and get your radar out so you can see what is going to happen BEFORE you enter into a situation that will end up in a medical cost spiral.”

“Wow! I just listened to Dr. Virgie’s book about medical debt (under 3 hours on Audible) and it was fantastic. Any educators out there should check it out for life skills class for high school and college and part of any health professional curriculum. Dr. Virgie uses her insight from her expertise on all three sides of the third-party payor system (doctor, health insurance exec, and patient) to simplify a complex issue and give action steps to address medical debt. I got value out of it and I am in the industry.”

– Dina Strachan, MD

“It’s a real tragedy that medical debt is the #1 cause of bankruptcy in the USA. This book is a good antidote. It’s important to note that according to this book, up to 90% of medical bills contain errors. Through case studies and lots of practical advice, the author does a great job of helping the reader avoid paying excessive and erroneous medical bills. An essential guide!”

“I have more than 20 years of clinical and financial expertise improving the efficiency and profits of healthcare organizations. In my experience, CRUSH MEDICAL DEBT will definitely show significant savings in employee turnover and healthcare costs.”

– Mary Doherty, DNP MSN Ed BSN RN

“What sets this book apart is the way it effortlessly teaches real-world solutions, making it a fast, easy, & comprehensive guide. It’s not just about information but empowerment, providing the tools necessary to navigate a predatory healthcare system. With thought-provoking content that is also direct and engaging, this book is suitable for anyone looking to protect their financial well-being. Whether as a gift or a personal investment, “Crush Medical Debt” is a practical book that could potentially save your life.”

“This book is going to help a lot of people – It’s definitely what we need.”

– Mitchell Li, MD

Emergency Medicine physician

Founder, Take Medicine Back

“The author sheds light on navigating the tricky terrain of medical bills without declaring bankruptcy. Think of this book as your healthcare financial compass, guiding you to fight an often predatory system. Don’t just glance over it, absorb it, and see how your worries about medical debt morph into empowerment. This book is a beacon of hope in the face of financial distress!”

Protect Your Finances from the

#1 Cause of Debt and Bankruptcy!

Get the latest Medical Financial Literacy content and resources to help you navigate the medical system and minimize healthcare costs for free in under 5 minutes.

Written by insider subject matter experts, not AI.